And remember, our services extend to your colleagues, family, and friends. Should they require assistance, we’re just a phone call away. We remain committed to identifying every opportunity to ensure our client’s prosperity. Your kind reviews and referrals are invaluable to us.

October Extended Due Date Just Around the Corner

Article Highlights:

- October 15, 2025, is the extended due date for 2024 federal 1040 returns.

- Late-filing Penalty

- Interest on Tax Due

- Other October 15 deadlines

If you could not complete your 2024 tax return by April 15, 2025, and are now on extension, that extension expires on October 15, 2025. Failure to file before the extension period runs out can subject you to late-filing penalties.

There are no additional extensions (except in designated disaster areas), so if you still do not or will not have all the information needed to complete your return by the extended due date, please call this office so that we can explore your options for meeting your October 15 filing deadline.

If you are waiting for a K-1 from a partnership, S-corporation, or fiduciary (trust) return, the extended deadline for those returns is September 15 (September 30 for fiduciary returns). So, you should probably make inquiries if you have not yet received that information.

Late-filed individual federal returns are subject to a penalty of 5% of the tax due for each month, or part of a month, for which a return is not filed, up to a maximum of 25% of the tax due. If you are required to file a state return and do not do so, the state will also charge a late-file penalty. The filing extension deadline for individual returns is also October 15 for most states.

In addition, interest continues to accrue on any balance due, currently at the rate of just over .5% per month.

If this office is waiting for some missing information to complete your return, we will need that information at least a week before the October 15 due date. Please call this office immediately if you anticipate complications related to providing the needed information, so that a course of action may be determined to avoid the potential penalties.

Additional October 15, 2025, Deadlines – In addition to being the final deadline to timely file 2024 individual returns on extension, October 15 is also the deadline for the following actions:

- FBAR Filings – Taxpayers with foreign financial accounts, the aggregate value of which exceeded $10,000 at any time during 2024, must file electronically with the Treasury Department a Financial Crimes Enforcement Network (FinCEN) Form 114, Report of Foreign Bank and Financial Accounts (FBAR). The original due date for the 2024 report was April 15, 2025, but individuals have been granted an automatic extension to file until October 15, 2025.

- SEP-IRAs – October 15, 2025, is the deadline for a self-employed individual to set up and contribute to a SEP-IRA for 2024. The deadline for contributions to traditional and Roth IRAs for 2024 was April 15, 2025.

- Special Note – Disaster Victims – If you reside in a Presidentially declared disaster area, the IRS provides additional time to file various returns, make payments and contribute to IRAs. Check this website for disaster related filing and paying postponements.

Please call this office for extended due dates of other types of filings and payments and for extended filing dates in disaster areas. Please don’t procrastinate until the last week before the due date to file your extended returns. Final note: if for whatever reason you miss the October 15 deadline, you should still file your return as soon thereafter as possible.

Exploring Tax Opportunities to Pay Off Student Loans

Article Highlights:

- Qualified Tuition Plans

- Employer Payments

- Paying Principal vs. Interest

- Public Service Loan Forgiveness

- Income-Driven Repayment Plans

- State-Level Programs

- Death or Disability Forgiveness

Paying off student loans can be a significant challenge for many graduates. However, leveraging tax-advantaged strategies can alleviate some of this burden. In this article, we’ll explore various tax opportunities to help pay off student loans, including Section 529 plans, Section 127 employer payments, and strategies related to paying principal versus interest. We’ll also highlight new provisions and permanency established by the One Big Beautiful Bill Act (OBBBA).

Qualified Tuition Plans: Qualified Tuition Plans (sometimes referred to as Section 529 plans) are plans established to help families save and pay for education expenses in a tax-advantaged way and are available to everyone, regardless of income.

These plans allow taxpayers to gift large sums of money for a family member’s education expenses, while continuing to maintain control of the funds. The earnings from these accounts grow tax-deferred and are tax-free, if used to pay for qualified education expenses. Here’s how they can help manage student loans:

- Tax-Free Withdrawals for Educational Expenses: 529 plans offer tax-free withdrawals for qualified educational expenses, including student loan repayments up to a lifetime limit of $10,000 per beneficiary.

- Recent Changes Under OBBBA: The OBBBA has expanded the uses of 529 funds. However, it’s important to note that any distributions from a 529 plan made for the purpose of paying student loans will not allow the beneficiary to claim student loan interest deductions.

Employer Payments: With education becoming a key benefit for recruits, many employers offer educational assistance:

- What Section 127 Covers: Under Section 127, employers can offer up to $5,250 annually in tax-free educational assistance, which can include student loan repayments.

- Permanency Due to OBBBA: This benefit was made permanent by the OBBBA legislation, offering a long-term planning opportunity for employees.

Paying Principal vs. Interest: When deciding how to allocate payments, understanding the tax implications can be crucial:

- Interest Deduction: For taxpayers itemizing their deductions, they are allowed to deduct student loan interest up to $2,500 per year. Thus, where possible it would be beneficial to allocate payments from Sec 529 plans and employer payments to principle and the taxpayer to pay the interest.

- Strategic Approaches: Balancing payments between principal and interest can optimize both tax benefits and debt reduction speed.

Additional Sources and Methods: Besides Sec 529 and Sec 127, other strategies can also aid in managing student loans:

- Public Service Loan Forgiveness (PSLF): The Public Service Loan Forgiveness (PSLF) program is a significant federal initiative designed to alleviate the financial burden of student loans for individuals committed to careers in public service. Established to incentivize and reward employment in essential public sectors, PSLF targets employees working full-time for qualifying employers, including government agencies, 501(c)(3) non-profit organizations, and certain other non-profit entities dedicated to public services. To benefit from PSLF, borrowers must make 120 qualifying monthly payments under a qualifying repayment plan while working with an eligible employer. Unlike many loan forgiveness programs, the PSLF discharges forgiven debt tax-free.

- Income-Driven Repayment Plans: Though not directly offering tax benefits, these plans can reduce monthly payments, enabling borrowers to use savings elsewhere, possibly toward tax-advantaged accounts.

- State-Level Programs: Some states offer tax incentives or repayment assistance programs for student loans. Check if your state provides such a benefit.

Death or Disability Forgiveness: It’s important to recognize the specific provisions related to student loan discharge under unfortunate circumstances:

- Tax-Free Discharge: Typically, student loans discharged upon death or total and permanent disability are excluded from taxable income. Emphasize planning for these situations to ease burdens on family or affected individuals.

- OBBBA Amendments: Significant changes have occurred with the OBBBA, where such discharge exclusions are reinforced, ensuring they remain effective well into the future.

Conclusion: A mindful approach to student loan repayment, utilizing various tax-advantaged opportunities and keeping abreast of legislative changes, can dramatically ease the financial pressure. Consultation with a tax professional can further personalize these strategies based on individual circumstances.

Uncertainty Is the New Normal: How Small Businesses Can Stay SteadyThe Economy Feels Mixed — and That’s Okay

If you’ve read the headlines lately, you know the signals are…confusing.

- GDP is strong.

- Interest rates may be heading lower.

- Inflation is easing, but not “gone.”

- Tariffs are making imports more expensive.

So is the economy strong? Slowing? Recovering? The truth is—it depends on who you ask. And for small business owners, that fog of uncertainty is the hardest part.

Uncertainty isn’t just an economic headline. It’s what keeps you up at night, wondering: Do I hire? Do I wait? Do I raise prices or hold steady?

Why Uncertainty Hurts More Than “Bad News”

When the outlook is unpredictable, planning becomes a guessing game. You can’t control the headlines, but you can control how your business responds. That’s where steady cash flow management, flexible budgets, and advisory support change everything.

How Small Businesses Can Adapt in Uncertain Times

1. Get a Grip on Cash FlowCash flow is your oxygen. Monitor it weekly, not quarterly. Use forecasting tools or dashboards that flag red zones before they become crises.

2. Build Flexible BudgetsRigid budgets snap in unpredictable markets. Scenario planning—“what if tariffs rise another 10%?”—lets you prepare before costs hit.

3. Diversify Where You CanFrom suppliers to revenue streams, diversification lowers risk. Even small shifts—like adding a second vendor—protect your business against shocks.

4. Tier Your Spending ControlsNot every dollar deserves equal treatment:

- Must control tightly: payroll, rent, core services.

- Flexible: marketing, equipment, travel.

- Growth bets: new hires, product launches.

This gives you a clear plan for what to trim (and what to protect) if the ground shifts.

Opportunity Inside the Fog

Uncertainty doesn’t only create risk—it opens doors. When competitors freeze, you can:

- Negotiate better supplier terms.

- Attract talent that others are too hesitant to hire.

- Double down on client loyalty while others cut service.

Strong planning plus calm execution turns uncertainty into opportunity.

The Big Picture: SMB Resilience Wins

- Lower rates and moderating inflation could spark growth.

- Small business optimism remains cautiously strong.

- With smart financial controls, you’ll be positioned to adapt faster than competitors.

Uncertainty isn’t going away. But with the right systems in place, it doesn’t have to run your business.

Next Step

Talk to our firm about building cash flow cushions, forecasting tools, and financial controls tailored to your business. With a plan in place, you’ll feel calmer, more confident, and better prepared for whatever comes next.

Because clarity—even in uncertain times—is a competitive advantage.

Vehicle Loan Interest Deduction A Restrained Tax Benefit

Article Highlights:

- The Deduction

- The Limitations: A Narrow Pathway to Eligibility

- Personal Use Vehicle

- No Recreational Vehicles

- Vehicle Loan

- Final Assembly

- Highway Use

- Income Limits

- Limited Availability

- The Enduring Question of Benefit Versus Burden

In the swirling complexities of tax legislation, even well-intentioned provisions can seem like offers of relief that arrive weighed down with restrictions. The OBBBA provision, which allows taxpayers to deduct up to $10,000 of interest paid on passenger vehicle loans, is poised to be one such measure. On the surface, it beckons with the promise of financial relief; however, for many taxpayers, the reality will be a confounding array of limitations that may render the deduction more symbolic than substantive.

The Limitations: A Narrow Pathway to Eligibility

The introduction of this provision is aimed at providing some respite amid the financial demands of owning a vehicle. Yet, the deductions are not as straightforward as they might appear. A myriad of limitations tightly gird this provision, potentially excluding a significant portion of taxpayers eager for relief.

- Personal Use Vehicle: To begin with, the provision caters exclusively to personal-use vehicles weighing in at 14,000 pounds or less. Any vehicle used for business, regardless of necessity or lack of corporate fleets, is unapologetically excluded. This distinction negates opportunities for small business owners or entrepreneurs who often blur the lines between personal and professional vehicle use. Furthermore, the provision applies only to new vehicles—a frustrating restriction for those who consciously choose to buy used cars, perhaps for economic or environmental reasons.

- No Recreational Vehicles: Although the definition of a passenger vehicle includes cars, minivans, vans, SUVs, pickup trucks, or motorcycles, recreational vehicles (RVs), fail to meet the criteria for qualified vehicles. Recreational vehicles encompass a variety of motorhomes and campervans.

- Vehicle Loan: The demand for the loan to be secured by the vehicle introduces another level of complication. A car must be held as collateral, and while this may not be an unusual requirement for an auto loan, it accentuates the notion of risk rather than relief to the taxpayer.One would think family and friends would be allies in such financial undertakings, but the provision explicitly disallows loans from these sources. Similarly, lease financing is also deemed unfit for this deduction, limiting options for those who prefer or require the flexibility of leasing over buying.

- Final Assembly: Perhaps one of the most daunting limitations is the requirement for final assembly of the vehicle to occur within the United States. The globalization of the automobile industry is such that even American brands often have some assembly lines abroad. Consequently, this restriction might serve more as a geopolitical statement than a practical guideline for taxpayers counting on financial relief.Moreover, the mandated list of qualifying vehicles, anticipated from the government, is still merely a promise. Without this list, taxpayers tread uncertain ground, unsure whether their chosen vehicle will ultimately qualify for the deduction.

- Highway Use: Adding to the complexity is the constraint that the vehicle must be manufactured for use on public streets, roads, and highways. This means that niche markets—such as those who buy golf carts or other specialized vehicles—will find themselves excluded, with no recourse under the current legislation.

- Income Limits: Income levels play yet another confounding role in the eligibility for this deduction. With a ceiling set at a modified adjusted gross income (MAGI) of $100,000 for single filers and $200,000 for joint filers, the phase-out of the deduction looms large. For each $1,000 of income surpassing these thresholds, the deduction diminishes by $200. Once the MAGI reaches $149,000 for single filers or $249,000 for joint filers, the deduction is entirely moot—the provision becomes obsolete for those hovering in the upper limits of the middle class.For instance, consider a single filer with a MAGI of $120,000. For these additional $20,000 over the threshold, the deduction shrinks by $4,000, resulting in a paltry remaining deduction of $6,000. Under these strictures, only taxpayers effectively within the 22% tax bracket can capture any significant benefit, and even then, the reduction in liability seems less than commensurate with the provision’s intent.

Should a taxpayer fall into the more modest 12% tax bracket, the deduction offers little solace—just a $12 decrease in liability for every $100 of interest deducted. In contrast, those in the 22% bracket witness a $22 reduction per $100, underscoring the inequitable assist the provision extends across income levels.

- Limited Availability: This provision is temporary, only available in 2025 through 2028 after which terminates unless extended by Congress.

The Enduring Question of Benefit Versus Burden

In the end, the OBBBA provision stands as a complex and confining measure within tax legislation. Its onerous limitations highlight the incongruities in navigating tax benefits—often leaving taxpayers with more questions than answers, and with benefits that seem increasingly out of reach. As it begins its tenure from tax year 2025 through 2028, taxpayers are left to wonder whether this interest deduction is a beacon of relief or an elusive concession under the guise of benefit.

Despite the numerous limitations that encircle the OBBBA provision, there is a bright spot that merits attention: the deduction’s accessibility to both those who itemize their deductions and those who opt for the standard deduction. This flexibility grants a wider net of eligibility, ensuring that taxpayers are not faced with the additional burden of reshaping their entire tax strategy to benefit from this provision. Whether a taxpayer meticulously itemizes every deductible expense or opts for the simplicity of the standard deduction, they have the opportunity to leverage this interest deduction.

Contact this office if you have questions.

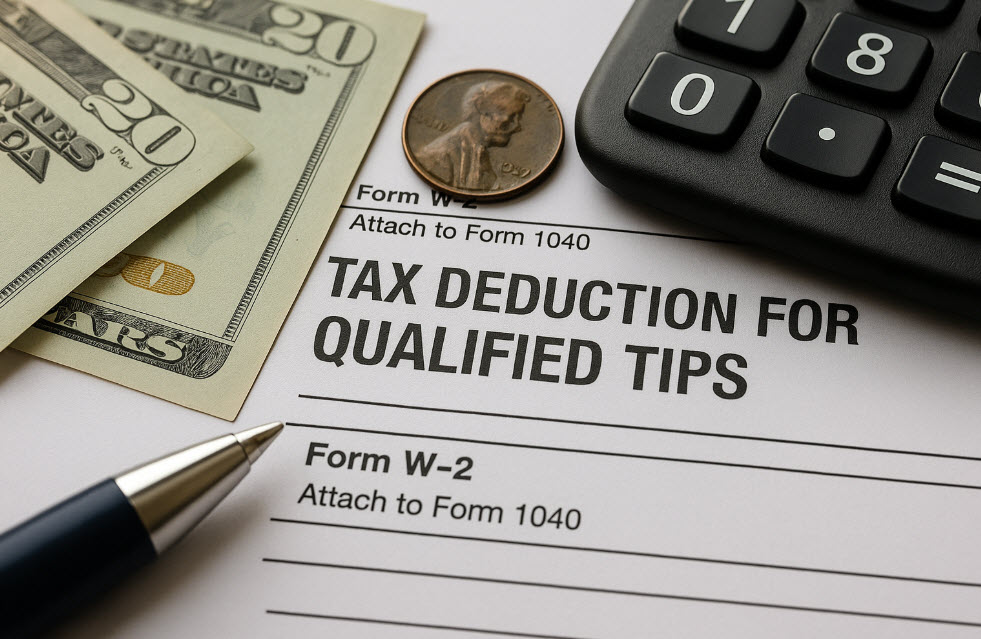

Occupations Qualified for Tip Deduction Released

Article Highlights:

- Draft List of Occupations:

o Beverage & Food Service

o Entertainment and Events

o Hospitality and Guest Services

o Home Services

o Personal Services

o Personal Appearance and Wellness

o Recreation and Instruction

o Transportation and Delivery - Eligibility Requirements

- Deduction Limitations

- Other Considerations

On September 2, 2025, the Treasury Department released a draft list of 68 occupations eligible for the new “no tax on tips” deduction. This deduction is part of the “One Big Beautiful Bill Act,” signed into law on July 4, 2025, and applies to federal income taxes for the 2025—2028 tax years.

The deduction is available for a maximum of $25,000 in qualifying tips per person, per year. It is structured as a “below-the-line” deduction, meaning it is available to taxpayers who take the standard deduction, but is not used to compute adjusted gross income (AGI).

Here is the Treasury’s draft list of occupations:

Beverage & Food Service:

- Bartenders

- Wait staff

- Food servers, non-restaurant

- Dining room and cafeteria attendants and bartender helpers

- Chefs and cooks

- Food preparation workers

- Fast Food and Counter Workers

- Dishwashers

- Host staff, restaurant, lounge, and coffee shop

- Bakers

Entertainment and Events:

- Gambling dealers

- Gambling change persons and booth cashiers

- Gambling cage workers

- Gambling and sports book writers and runners

- Dancers

- Musicians and singers

- Disc jockeys (except radio)

- Entertainers and performers

- Digital content creators

- Ushers, lobby attendants and ticket takers

- Locker room, coatroom and dressing room attendants

Hospitality and Guest Services:

- Baggage porters and bellhops

- Concierges

- Hotel, motel and resort desk clerks

- Maids and housekeeping cleaners

Home Services

- Home maintenance and repair workers

- Home landscaping and groundskeeping workers

- Home electricians

- Home plumbers

- Home heating/air conditioning mechanics and installers

- Home appliance installers and repairers

- Home cleaning service workers

- Locksmiths

- Roadside assistance workers

Personal Services

- Personal care and service workers

- Private event planners

- Private event and portrait photographers

- Private event videographers

- Event officiants

- Pet caretakers

- Tutors

- Nannies and babysitters

Personal Appearance and Wellness

- Skincare specialists

- Massage therapists

- Barbers, hairdressers, hairstylists and cosmetologists

- Shampooers

- Manicurists and pedicurists

- Eyebrow threading and waxing technicians

- Makeup artists

- Exercise trainers and group fitness instructors

- Tattoo artists and piercers

- Tailors

- Shoe and leather workers and repairers

Recreation and Instruction

- Golf caddies

- Self-enrichment teachers

- Recreational and tour pilots

- Tour guides and escorts

- Travel guides

- Sports and recreation instructors

Transportation and Delivery:

- Parking and valet attendants

- Taxi and rideshare drivers and chauffeurs

- Shuttle drivers

- Goods delivery people

- Personal vehicle and equipment cleaners

- Private and charter bus drivers

- Water taxi operators and charter boat workers

- Rickshaw, pedicab, and carriage drivers

- Home movers

The requirements for the OBBB tip exclusion are a set of temporary tax deductions for qualified tipped workers, available for tax years 2025 through 2028. The deduction is taken on an individual’s tax return and is subject to income limitations.

Eligibility Requirements: To be eligible for the deduction, a worker must meet the following criteria:

- Be a qualified tipped worker: Must be an employee or independent contractor in an occupation that customarily and regularly received tips before 2025. See the draft list of qualifying occupations.

- Have qualified tips: The tips must be voluntarily paid by a customer. This includes tips received in cash, charged on a credit card, or from a tip-sharing arrangement. Mandatory service charges are not eligible.

- Properly report tips: The tips must be reported to the IRS on either a Form W-2 (for employees) or Form 1099 (for independent contractors).

- File jointly if married: If married, the couple must file a joint tax return to claim the deduction.

- Provide a Social Security Number (SSN): Anyone claiming the deduction must include their SSN on their tax return.

Deduction Limitations: The maximum deduction is limited and phases out for high-income earners:

- Maximum deduction: The maximum annual deduction is $25,000.

- Income phase-out: The deduction is gradually reduced for taxpayers with a modified adjusted gross income (MAGI) over a certain amount:

- Single filers: The deduction begins to phase out for MAGI over $150,000.

- Married filing jointly: The deduction begins to phase out for MAGI over $300,000.

Other Considerations:

- Does not apply to payroll taxes: While tips are deductible from the worker’s income when figuring their federal income tax, they are still subject to Social Security and Medicare taxes or self-employment tax in the case of independent contractors.

- Temporary provision: The tip deduction is a temporary measure, scheduled to expire after December 31, 2028.

- Not tax-free: This is a deduction, not an exemption. So, the worker will still have to report all tip income, which will then be reduced by the deduction amount.

- State tax implications: The effect on state income taxes will depend on the worker’s state’s tax laws.

In conclusion, understanding which occupations qualify for tip deductions is essential for both employees and employers seeking to maximize their tax benefits. By staying informed about the specific criteria that define qualified tips and knowing how different occupations fit into this framework, individuals can ensure compliance while optimizing their tax strategies. As tax laws continue to evolve, it remains crucial for stakeholders to stay updated on legislative changes and seek professional advice as needed to navigate the complexities of tip income and deductions effectively.

Contact this office with questions and assistance.

Act Now – Last Chance to Leverage the Work Opportunity Tax Credit Before It Sunsets in 2025!

Article Highlights:

- Understanding the Work Opportunity Tax Credit

- Eligible Target Groups

- Credit Amounts and Limitations

- Certification Process

- Fast-tracked Certification for Veterans

- When the Credit is Not Available

- Implications for Tax-Exempt Employers

- The Urgency to Act

The Work Opportunity Tax Credit (WOTC) has long been a valuable tool for employers looking to leverage tax savings while providing employment opportunities to individuals from specified target groups. As the credit stands to sunset after December 31, 2025, without any Congressional action to extend it, this may represent the final opportunity for businesses to capitalize on its benefits. This article delves into the intricacies of the WOTC, including the qualifications, targeted groups, eligible working hours, and the certification process that employers must be aware of to make the most of this potential tax savings.

Understanding the Work Opportunity Tax Credit: The WOTC is a federal tax credit available to employers’ hiring individuals from certain groups who have historically faced significant barriers to employment. The aim is to incentivize employers to select candidates from these groups, thus helping to diversify and strengthen the workforce. Eligible individuals must commence their employment before January 1, 2026, to qualify under the current legislation.

Eligible Target Groups: The WOTC focuses on a variety of target groups, including but not limited to:

- Veterans: Particularly those unemployed for at least four weeks or are service-connected disabled veterans.

- Long-term Unemployed: Individuals unemployed for 27 consecutive weeks or more.

- Ex-Felons: Individuals with difficulty finding employment due to their past convictions.

- Supplemental Nutrition Assistance Program (SNAP) Recipients: Individuals who have received food stamps in the past 6 months.

- Temporary Assistance for Needy Families (TANF) Recipients: Those who have received assistance within the last 2 years.

- Designated Community Residents and Summer Youth Employees: Individuals aged 18 to 39 residing in Empowerment Zones.

- Vocational Rehabilitation Referrals: Those with physical or mental disabilities who have been referred through a rehabilitation agency.

The crucial aspect of the WOTC is ensuring that these individuals start their employment before the defined deadline, despite Congressional habits of extending the credit in the past.

Credit Amounts and Limitations: The WOTC allows employers to claim a tax credit for a portion of the wages paid to these eligible employees. The amount varies based on the target group and the number of hours worked:

- General Rule: Up to 40% of the first $6,000 paid to or incurred on behalf of an employee, translating to a maximum credit of $2,400 per employee.

- Veterans: For disabled veterans, the credit can reach up to $9,600 if certain conditions are met.

- Long-term Unemployed: The credits for this group can be substantial, with provisions allowing for credits up to $5,000.

To qualify, an employee must work at least 120 hours. If the employee works at least 400 hours, employers can claim the full 40% of the first-year wages. If between 120 and 399 hours, the credit rate is reduced to 25%.

Certification Process: Securing WOTC requires navigating the certification process with the State Workforce Agency (SWA). Employers need to submit IRS Form 8850, the Pre-Screening Notice and Certification Request for the Work Opportunity Credit, along with the Department of Labor’s Employment and Training Administration’s (ETA) Form 9061 or 9062 within 28 days of the eligible employee’s start date.

Fast-tracked Certification for Veterans: Veterans generally face a more streamlined certification process. Given the emphasis on supporting veterans, there are expedited procedures that ensure a quicker determination of eligibility, allowing employers to swiftly access the benefits tied to hiring veterans.

When the Credit is Not Available: Certain restrictions apply to the availability of the WOTC:

- Relatives and Dependents: An employer cannot claim the credit for hiring their spouse, children, or any other dependents.

- Majority Owners: In cases where the employer is the majority owner of the business, hiring themselves or any other major stakeholders does not qualify for the WOTC.

- Federal Subsidized Employment Programs: Wages paid under specific federal subsidized employment programs may not be used towards the WOTC.

Implications for Tax-Exempt Employers: While tax-exempt organizations such as 501(c) entities can benefit from the WOTC, the credit mechanics differ. These organizations can only claim the WOTC for hiring qualified veterans, and the credit can only be applied against the employer Social Security tax.

The Urgency to Act: With the looming sunset on December 31, 2025, businesses need to act swiftly if they have not already capitalized on the WOTC. Unless Congress intervenes—which has been the historical pattern but is not guaranteed—this significant tax credit will no longer be available. Furthermore, despite the past trends of extension, the lack of current Congressional action makes this deadline more pressing than ever before.

Employers looking to reduce their tax liability while making impactful hiring decisions should prioritize understanding and utilizing the WOTC. By doing so, not only do they gain financially, but they also contribute positively to the broader societal goals of employment for those facing systemic barriers. Time is of the essence, and ensuring all certifications and documentation are in order promptly will be critical to reaping the benefits of this important soon-to-expire tax credit.

Contact this office with questions and how this credit might apply to our business.

Understanding the Estate and Gift Tax Changes Under the One Big Beautiful Bill Act

Article Highlights:

- Basics of the Estate and Gift Tax Exclusion

- Estate and Gift Tax Exclusions: Key Adjustments

- Impact on Generation-Skipping Transfers

- Benefits of the Portability Election

- Strategic Implications for Wealth Management

The One Big Beautiful Bill Act (OBBBA) recently introduced substantial changes in the realm of estate and gift tax planning. These changes present new opportunities for taxpayers. The legislation modifies critical aspects of the estate tax exclusion, making long-term planning both more urgent and more strategic for affluent taxpayers.

Basics of the Estate and Gift Tax Exclusion: The estate and gift tax exclusion is the amount that can be excluded from federal estate tax. If the value of a decedent’s estate is less than the exclusion amount for the year of death ($13.99 million in 2025), no federal estate tax is owed and no estate tax return is required, but in some cases filing an estate tax return may still be prudent (see Benefits of the Portability Election below).

If the value of gifts one individual gives to another person during a year is greater than that year’s annual gift tax exclusion ($19,000 for 2025), the individual making the gift must file a gift tax return (IRS Form 709), but often will owe no gift tax. This is because the gift giver can dip into their combined lifetime estate and gift tax exclusion and apply it to the excess gift amount. When the individual passes away, a reconciliation must be done to see if the combination of excess gifts and the value of the individual’s estate exceeds the lifetime estate and gift tax exclusion, which varies from year to year. This is done on IRS Form 706.

Estate and Gift Tax Exclusions: Key Adjustments: The OBBBA has effectively “permanently” set the estate and gift tax exclusion at $15 million per individual starting in 2026, adjusted for inflation in the following years. This decision is a continuation of the trend initiated by the Tax Cuts and Jobs Act of 2017 (TCJA), which doubled the previous $5 million exclusion to $10 million, again indexed for inflation, but only through 2025. Prior to the OBBBA, the expectation was that this exclusion would drop significantly to about $7 million, essentially rolling back to the pre-TCJA levels, adjusted for inflation. However, with the OBBBA’s intervention, a more favorable scenario for high-net-worth individuals has been preserved.

This adjustment helps taxpayers engage in more precise planning for their estates, allowing them to pass on more wealth without triggering tax obligations. It offers a level of stability and predictability that can be pivotal in both long-term estate planning and immediate asset management strategies.

Impact on Generation-Skipping Transfers: In tandem with the estate and gift tax exclusions, the Generation-Skipping Transfer (GST) tax exclusion has also been aligned. The GST tax is a federal tax levied on transfers that skip a generation, such as from grandparents directly to grandchildren, bypassing the parents. Under OBBBA, the GST exclusion mirrors the estate and gift tax exclusion, set at $15 million from 2026 and indexed thereafter. This move curbs the potential tax-free transfer across generations, ensuring that wealth passed in such a manner is adequately taxed while still allowing for strategic planning opportunities to mitigate tax exposure.

Benefits of the Portability Election: An often-overlooked strategy for married couples in estate planning involves the portability election, which can be particularly beneficial upon the death of the first spouse. This election allows the surviving spouse to utilize any unused portion of the deceased spouse’s estate and gift tax exclusion. By leveraging this mechanism, couples can effectively maximize the tax exclusions available to them.

For example, if the estate of a spouse who dies in 2026 does not use their full $15 million exclusion, the remainder can transfer to the surviving spouse’s exclusion, potentially doubling the couple’s tax-free transfer capability. This process can significantly alleviate the financial burden on the surviving spouse and provide more flexibility and security in managing and distributing their estate as desired. It is an essential tool in a comprehensive estate planning strategy, particularly under the current tax environment shaped by the OBBBA.

To take advantage of this election, the executor of the estate of the first spouse to die must file a timely Form 706, even if there is no estate tax owed.

Strategic Implications for Wealth Management: The changes introduced by the OBBBA necessitate a fresh look at existing estate plans. Taxpayers who had previously braced themselves for a reversion to lower exclusion thresholds now have the opportunity to further leverage the increased exclusions in their planning strategies. This means reevaluating current plans to make the most of the permanent $15 million exclusion cap, aligning it with long-term financial goals and family wealth aspirations.

For estate planning professionals, the OBBBA offers both a challenge and an opportunity. The permanence of these provisions requires planners to incorporate them into dynamic and flexible estate plans that can withstand the test of inflation, economic fluctuations, and potential future legislative changes. Deploying gifts, trusts, and other tools efficiently will be critical in optimizing these tax benefits.

Conclusion: The estate and gift tax landscape, shaped by the One Big Beautiful Bill Act, presents complex but rewarding planning opportunities. With increased exclusions, aligned GST provisions, and the beneficial portability election, taxpayers and estate planners can navigate these waters effectively to ensure wealth preservation across generations. As such, now is an ideal time for affluent individuals to consult with their tax advisors and estate planners to reassess and optimize their strategies.

The IRS Just Got Leaner – But Not Softer on Enforcement

The IRS is going through what you might call an identity crisis. Thousands of employees have been laid off right in the middle of tax season, including auditors, tech staff, and even customer service reps. Throw in yet another commissioner swap and a partial reset on their modernization plans, and you’ve got a recipe for confusion.

And here’s the kicker: confusion at the IRS doesn’t mean less enforcement. It usually means more automation, fewer humans to talk to, and longer waits for everyone else.

Customer Service? Don’t Count On It

Think of the IRS right now as an understaffed call center. Reduced phone support, fewer walk-in centers, and slower processing times mean that if your return gets flagged, it could sit there… and sit there.

Refunds delayed. Notices piling up. Stress levels: climbing.

Enforcement: Smarter, Not Softer

Yes, audit staffing has been slashed. But don’t mistake that for mercy. The IRS is shifting gears and leaning into automation and AI to spot inconsistencies. That means crypto transactions, offshore accounts, and suspicious deductions are more likely than ever to trigger a letter.

And enforcement isn’t random. The IRS has made clear it’s targeting high-income taxpayers and complex cases — think business owners, real estate investors, and anyone with large deductions or overseas holdings. If you fall into one of these categories, assume you’re on their radar.

When it comes to collections? They’re dusting off the old tools: bank levies, wage garnishments, even door-knocks from Revenue Officers. AI doesn’t sleep — and it doesn’t lose paperwork.

Red Flag Watchlist for 2025

If you’re in any of these categories, expect a sharper eye on your return:

- Cryptocurrency transactions – unreported gains are low-hanging fruit.

- ERC or PPP claims – IRS is cracking down on fraud and aggressive filings.

- Offshore accounts – FBAR and FATCA enforcement are heating up.

- High deductions or credits – especially for small businesses and self-employed taxpayers.

- High-income filers – the IRS is prioritizing audits of wealthy individuals.

Tip: If one (or more) of these fits you, get documentation in order before filing. A tax pro can help you preempt problems rather than scramble after the fact.

Why a Tax Pro Is Your Secret Weapon

Here’s the good news: you don’t have to navigate this mess alone. A seasoned pro knows how to:

- Cut through the red tape. While everyone else is waiting on hold, pros know back channels and proven strategies like First-Time Abatement or structured installment plans.

- Stop false alarms. When algorithms overreach, a pro can push back with logic and documentation.

- Protect you from penalties. From high-net-worth audits to offshore reporting, the right strategy today can prevent years of pain tomorrow.

In a world where the IRS is both shrinking and sharpening, having a pro in your corner isn’t optional — it’s insurance.

What Taxpayers Should Do Right Now

- File early and electronically.

- Document everything — especially crypto, business, or side hustle income.

- Stay ahead of new rules (like the recently passed No Tax on Tips Act).

- Call in help if your return is anything more than straightforward.

The Bottom Line

The IRS is a paradox in 2025: smaller in size, bigger in bite. They’re rolling out fewer humans, more automation, and sharper tools for enforcement.

For taxpayers, that means two things:

- Don’t assume you’ll slip through the cracks.

- Don’t assume you can handle it all alone.

Because while the IRS figures itself out, you still have to figure out your taxes. And the smartest move you can make this year? Have a seasoned pro in your back pocket.

Contact us today to get expert guidance before the IRS comes knocking.

Tariffs Just Handed You Growth. Now Comes the Hard Part.

Your order book is fuller than ever. Buyers who once sourced overseas are knocking on your door. Tariffs and trade wars are pushing work back to U.S. soil. You’re in demand.

But here’s the problem no one warns you about: growth this fast can break you.

The policies fueling today’s boom could flip overnight. The people you need to hire? They don’t exist in enough numbers. And those shiny new contracts you signed? Without the right clauses, they could trap you if tariffs swing the other way.

This is what hypergrowth feels like. Thrilling. And terrifying.

The Big Picture: Why You’re Growing So Fast

Right now, global pharma firms are pouring billions into U.S. facilities to hedge against tariffs. GM is building a $3.5B EV battery plant in Indiana to avoid Chinese supply chains.

The message is clear: being U.S.-based is suddenly a competitive advantage. Your customers are ready to pay for it.

But here’s the catch—tariffs are a policy, not a promise. Tomorrow’s headlines could undo today’s opportunities. That’s why scaling fast without a strategy is like building a factory on sand.

The Hidden Traps of Hypergrowth

- Policy whiplash. Tariffs today. Rollbacks tomorrow. The last thing you want is to invest millions in capacity that evaporates with one policy change (how tariffs upend supply chains).

- Hiring panic. You need skilled machinists, welders, engineers—yesterday. The temptation is to hire fast, train later. But weak hires compound into quality issues, OSHA violations, and even cultural breakdowns.

- Supply chain choke points. You’re no longer just making product—you’re now juggling suppliers, tariffs, and customs paperwork. That one missing component? It can hold up millions in orders (tariffs reshaping supply chains).

- Contracts that corner you. If you’re not baking in “change-in-law” clauses, price adjustments, and exit triggers, you’re betting your margins on D.C. politicians (strategic insights on tariffs).

Growth without guardrails is risk dressed up as opportunity.

What Smart Manufacturers Are Doing Differently

They’re not just producing more. They’re building resilience into their DNA.

- They diversify suppliers—not just in the U.S., but in allied “friend-shoring” countries where tariffs aren’t weaponized (friendshoring explained).

- They scenario-test—running drills on what happens if tariffs rise, suppliers fail, or policy shifts. So nothing catches them flat-footed.

- They lean on automation—like Keen’s U.S. shoemaking plant, which used robotics to expand output without blowing up payroll.

- They fortify contracts—future-proofing against tariff reversals or sudden policy pivots.

- They protect cash flow—using supply chain finance and liquidity buffers to avoid getting crushed when margins tighten (supply chain finance under tariffs).

Stories That Prove the Point

- Auburn Manufacturing doubled sales by going all-in on local supply chains, proving that resilience sells (Auburn Manufacturing).

- MP Materials built rare-earth capacity in Texas and secured $500M from Apple by planning for volatility, not stability (MP Materials).

These aren’t just wins. They’re blueprints.

Your Playbook for Managing Growth Without Breaking

- Pause before you pounce. Growth is good, but build forecasts around multiple tariff scenarios.

- Hire slow, train fast. Prioritize culture and quality—then invest in upskilling to fill gaps.

- Automate where it hurts. Let machines take pressure off your labor shortages.

- Rework contracts. If the law changes tomorrow, your agreements should flex with it.

- Keep liquidity strong. Growth eats cash. Make sure your financial buffers scale too.

Growth Without Strategy Is Just Risk in Disguise

Yes, tariffs are fueling your momentum. But without foresight, they can just as easily fuel your downfall. The winners in this moment aren’t the ones who scale the fastest—they’re the ones who scale the smartest.

Contact us today to design your growth strategy—so tariffs and trade wars become opportunities, not landmines.

How the Adoption Credit Can Ease Your Path to Parenthood

Article Highlights:

- Overview of the Adoption Credit

- Eligibility and Definitions

- Financial Considerations

- Specific Circumstances and Rules

- Adoption Process Essentials

- Tax Benefits Beyond the Adoption Credit

Are you in the process of or thinking about adopting? The tax code includes an adoption credit which is a significant benefit available to taxpayers who adopt a child, providing financial relief for eligible expenses. For the 2025 tax year, there have been notable enhancements to the adoption credit.

Overview of the Adoption Credit: The adoption credit is designed to assist adoptive families by offsetting some of the costs associated with adoption. In 2025, the adoption credit is capped at $17,280 for qualified expenses per adoption (not per return). A pivotal update this year is that part of the credit, up to $5,000, is refundable. This new feature allows adoptive families to receive a cash refund if the credit exceeds their total tax liability.

Eligibility and Definitions

- Eligible Child: For the purposes of the adoption credit, an eligible child is defined as any individual

August marks the close of summer and a prime opportunity to review your year-to-date progress.

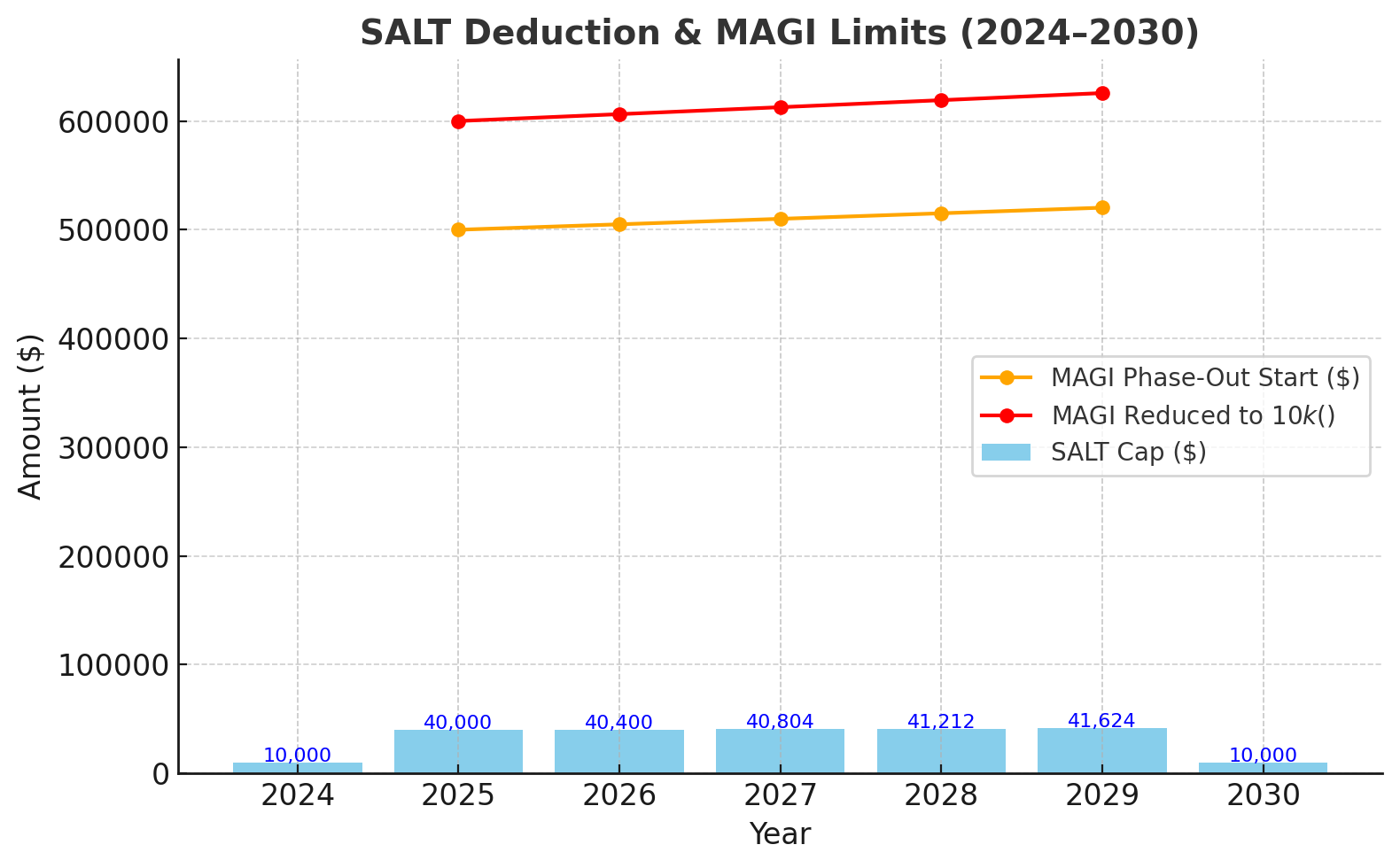

August marks the close of summer and a prime opportunity to review your year-to-date progress. The SALT Deduction: A Quick Refresher

The SALT Deduction: A Quick Refresher The OBBBA Update (Starting 2025)

The OBBBA Update (Starting 2025) Dead inventory is a silent profit killer.

Dead inventory is a silent profit killer. Article Highlights:

Article Highlights:

You’ve built something real.

You’ve built something real.