August marks the close of summer and a prime opportunity to review your year-to-date progress. With the final months of the year approaching, now is the time to fine-tune your financial strategy, address any gaps, and take advantage of current opportunities. Staying organized and informed about the latest tax and business developments will help you keep your plans on track through year-end.

August marks the close of summer and a prime opportunity to review your year-to-date progress. With the final months of the year approaching, now is the time to fine-tune your financial strategy, address any gaps, and take advantage of current opportunities. Staying organized and informed about the latest tax and business developments will help you keep your plans on track through year-end.

This month, we’re diving into how the “One Big Beautiful Bill Act” (OBBBA) could shape your 2025 taxes, smart inventory tactics to prevent dead stock from cutting into profits, the newest IRS “Dirty Dozen” scams to watch for, and the OBBBA provisions every senior should know. Our goal is to help you wrap up summer strong and enter the fall with clarity and confidence.

See How the “One Big Beautiful Bill” Act Will Impact Your 2025 Taxes and Transform Your Financial Landscape

Article Highlights:

- Standard Deduction Increase

- Special Temporary Deduction for Seniors

- Child Tax Credit

- Qualified Small Business Stock (QSBS) Exemption

- New Deduction for Tips

- Overtime Deduction

- Deduction for Car Loan Interest

- Adoption Credit

- 529 Savings Plan Enhancements

- Bonus Depreciation

- Qualified Production Property Special Depreciation Allowance

- Third-Party Network Transaction Reporting (1099-Ks)

- Termination of Various Environmental Tax Credits

- Domestic Research Expenditures

- SALT Deduction Changes

On July 4th, the President signed into law the “One Big Beautiful Bill” Act (OBBBA)—a sweeping piece of legislation introducing multiple tax changes that will affect individuals, families, and businesses starting in 2025. While some provisions extend beyond this year, our focus is on those coming into effect next year, so you can plan ahead.

Several environmental credits are set to end as early as September 30, 2025. If you want to benefit from these before they disappear, timely action will be essential. This summary outlines the key updates so you can evaluate their relevance to your situation and make informed decisions before year-end.

Key Tax Law Changes for 2025

Standard Deduction Increase

- $15,750 – Single/Married Filing Separately

- $23,625 – Head of Household

- $31,500 – Married Filing Jointly

- Indexed for inflation in future years.

Special Temporary Deduction for Seniors (2025–2028)

- $6,000 for individuals age 65+ ($12,000 per couple if both qualify).

- Income limits: MAGI ≤ $75,000 (single) or $150,000 (joint).

- Available to both itemizers and non-itemizers; does not replace the additional standard deduction for seniors.

Child Tax Credit

- Increased to $2,200 per child.

- Phaseouts: $400,000 (joint filers) and $200,000 (others).

- Both parent(s) and child must have Social Security numbers.

Qualified Small Business Stock (QSBS) Exemption

- Applies to C Corporations; acquired after July 4, 2025.

- 50% exclusion after 3 years, 75% after 4 years, 100% after 5 years.

- Subject to limits—consult our office to determine eligibility.

New Deduction for Tips (Through 2028)

- Up to $25,000 annually for qualifying tipped occupations.

- Income phaseouts start at $150,000 (single) or $300,000 (joint).

- Not available for specified service businesses (e.g., law, accounting, consulting).

- IRS list of qualifying occupations expected by October 2, 2025.

Overtime Deduction (Through 2028)

- Excludes certain overtime pay above the regular rate from taxable income.

- Same phaseouts as tip deduction.

- Employers will report eligible overtime on Form W-2 or similar.

Deduction for Car Loan Interest (Through 2028)

- Up to $10,000 interest deduction for loans on U.S.-assembled vehicles.

- Phaseouts begin at $100,000 (single) and $200,000 (joint).

- VIN must be provided on return.

Adoption Credit (2025–2028)

- Partially refundable up to $5,000.

529 Savings Plan Enhancements

- K–12 and homeschool expense limit doubled to $20,000 (from $10,000) for distributions after July 4, 2025.

- Now includes qualified postsecondary credentialing expenses.

Bonus Depreciation

- Restored to 100% permanently for qualifying business property acquired after Jan. 19, 2025.

Qualified Production Property Special Depreciation Allowance

- 100% immediate deduction for certain new or improved factory property.

- Must begin construction after Jan. 19, 2025, and before Jan. 1, 2029; in service before Jan. 1, 2031.

Third-Party Network Transaction Reporting (1099-K)

- Reporting threshold returns to $20,000 and more than 200 transactions per year.

Termination of Environmental and Energy Credits

- Previously Owned Clean Vehicle Credit – Ends Sept. 30, 2025.

- New Clean Vehicle Credit – Ends Sept. 30, 2025.

- Commercial Clean Vehicle Credit – Ends Sept. 30, 2025.

- Alternative Fuel Vehicle Refueling Credit – Ends Sept. 30, 2025.

- Energy Efficient Home Improvement Credit – Ends Dec. 31, 2025.

- Solar Energy Credit – Ends Dec. 31, 2025.

Domestic Research Expenditures

- Immediate deduction allowed for domestic research starting in 2025.

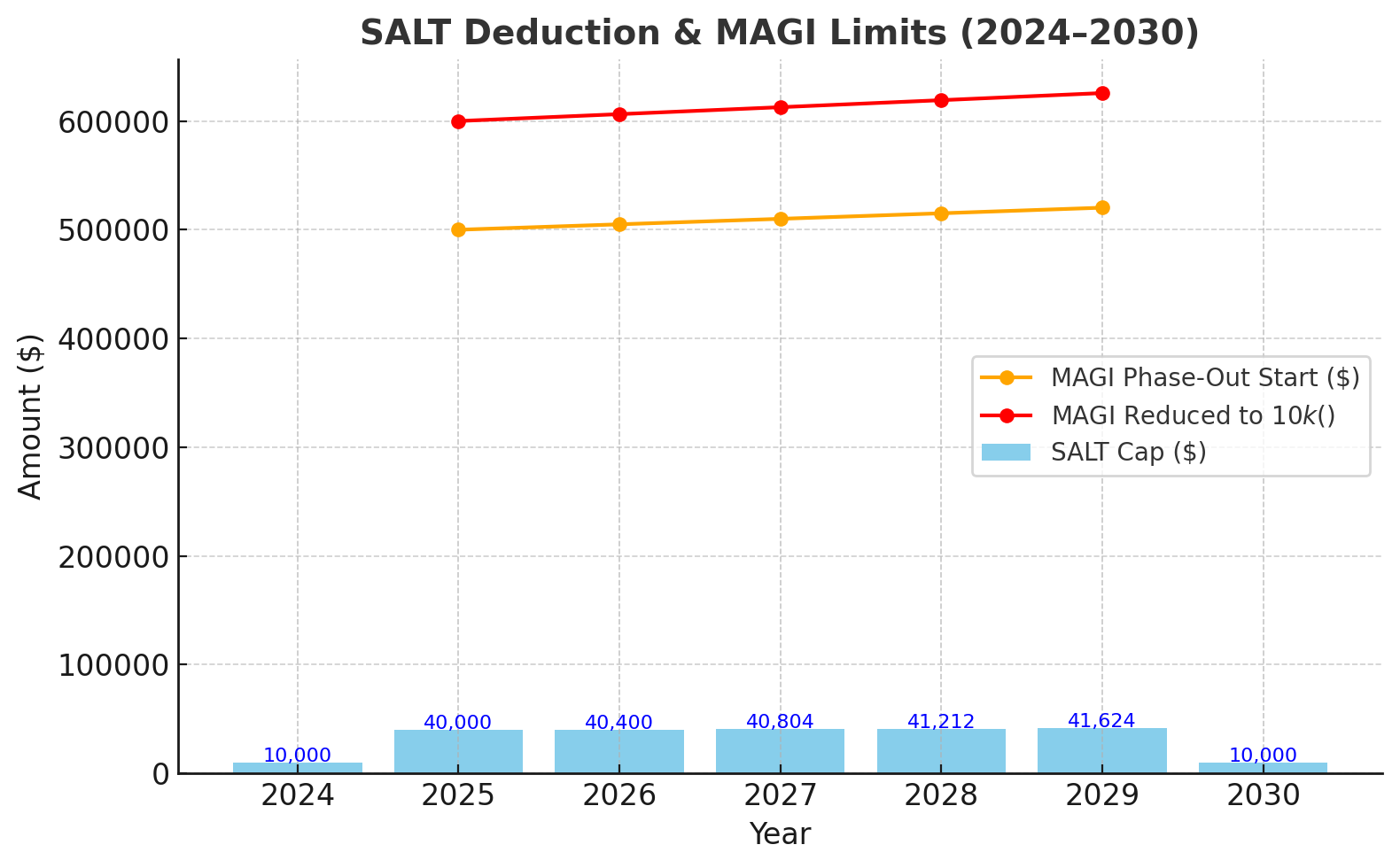

SALT Deduction Changes

- Cap increases to $40,000 in 2025, with gradual annual increases until 2029, then reverts to $10,000.

- Phaseout begins at MAGI $500,000; fully reduced back to $10,000 at MAGI $600,000+.

Final Thoughts

We’re committed to helping you make the most of these updates and ensuring your strategy stays on track. If you have questions about how the “One Big Beautiful Bill Act” or other recent developments could affect your personal or business finances, contact us to schedule a consultation.

And remember—our expertise is available to your friends, family, and colleagues as well. Your referrals and kind reviews mean the world to us and help us continue supporting clients in achieving lasting success.

Navigating SALT Deduction Changes and Passthrough Entity Strategies

The SALT Deduction: A Quick Refresher

The SALT Deduction: A Quick Refresher

The State and Local Tax (SALT) deduction lets you deduct state/local income or sales taxes plus property taxes if you itemize. For years, this helped offset double taxation—especially in high-tax states.

Before & After the TCJA

- Pre-2018: No SALT deduction cap.

- Post-TCJA (2018–2024): Capped at $10,000 ($5,000 if married filing separately).

The OBBBA Update (Starting 2025)

The OBBBA Update (Starting 2025)

Beginning in 2025, the SALT cap increases significantly and adjusts annually until 2029, then reverts unless extended.

SALT Deduction Cap & MAGI Limits (2024–2030)

(Half these amounts apply to married couples filing separately.)

Limits for High-Income Taxpayers

The OBBBA phases out the SALT deduction for high earners based on Modified Adjusted Gross Income (MAGI).

- Phase-out starts when MAGI exceeds the yearly threshold.

- Deduction is reduced by 30% of income above that level.

- At the upper MAGI limit, the deduction drops back to $10,000.

Example:

- 2027: SALT cap = $40,804.

- MAGI $523,000 → Deduction reduced by $3,885 → New max = $36,919.

- MAGI $615,000 → Reduced to $10,000.

Passthrough Entity Workarounds (PTET)

Many states offer PTET programs letting S corporations and partnerships pay state tax at the entity level. This allows the business to deduct the tax federally, bypassing the SALT cap for individual owners—who receive a state tax credit in return.

Why This Matters

The OBBBA offers temporary relief for many taxpayers, but high-income earners may see limited benefit. PTET strategies can provide an alternative path to maximize deductions in high-tax states.

Next Steps

If your SALT deduction will be reduced by your income level, contact our office to see if your state’s PTET program could work for you.

Mid-Year Inventory Assessment: Don’t Let Dead Stock Eat Your Margins

Dead inventory is a silent profit killer.

Dead inventory is a silent profit killer.

You might not notice it right away, but it’s sitting there—on the shelf, in the warehouse, or in the “we’ll get to it later” pile—quietly draining your cash flow. By the time you realize how much money is tied up in unsold products, it’s often too late to recover the lost opportunity.

Mid-year is the perfect time to act.

This is your chance to take a hard look at your stock, clear out what’s holding you back, and adjust your strategy before the year-end rush.

Why This Matters in 2025

This year has been especially challenging for inventory management:

- Higher holding costs

- Tariff and port delay uncertainties

- Shifts in consumer demand

- Leftover “just in case” stock from last year

The result? Many businesses are sitting on more inventory than planned—and less liquidity than they need. The good news is that slow-moving stock can be turned around—if you catch it early.

Mid-Year Inventory Assessment Checklist

1. Do a Physical Inventory Count

Don’t rely solely on what the system says—verify what’s actually on your shelves. Discrepancies lead to poor purchasing decisions and distorted forecasts.

2. Run a Sales Velocity Report

Identify what’s selling and what’s been sitting for 90–180 days. If it hasn’t moved in three to six months, it’s not inventory—it’s overhead.

3. Understand the True Cost of Holding Inventory

Slow-moving stock:

- Ties up cash flow

- Consumes storage and warehouse space

- Increases insurance costs

- Raises theft, damage, and obsolescence risks

- Delays the introduction of higher-margin products

4. Identify True Dead Stock

Flag anything outdated, expired, or through multiple sales cycles without selling. If it hasn’t sold in six months and isn’t seasonal, it’s time to move it out.

5. Plan Strategic Promotions or Exit Strategies

Options include:

- Bundling slow movers with popular items

- Limited flash sales

- VIP or loyalty-only promotions

- Repackaging or repositioning products

If they still don’t move—consider donating, liquidating, or repurposing.

6. Use Data to Forecast Smarter

Learn from what’s not selling. Was demand overestimated? Was it a passing trend? Apply these lessons to Q3/Q4 buying decisions to reduce overstock and improve cash flow.

Bonus: Track your Inventory Turnover Ratio to measure how often inventory is sold and replaced. Low turnover means cash is stuck in products; high turnover means healthier margins.

Final Word: Take Control Before It’s Too Late

Inventory should work for you—not against you. Waiting until December to fix a July problem means missed profits and tighter cash flow.

If you want a second set of eyes on your inventory strategy, we can help. We work with business owners to review stock performance, identify financial opportunities, and build proactive plans that protect margins year-round.

Contact our office today to start your mid-year inventory assessment.

Examining the Impact: How the ‘One Big Beautiful Bill Act’ (OBBBA) Might Apply to You

Article Highlights:

Article Highlights:

-

- Individual Tax Rates

- Standard Deductions

- Senior Tax Deduction

- Child Tax Credit

- Qualified Business Income (QBI) Deduction & Minimum QBI Deduction

- Estate and Gift Tax Exemption

- Alternative Minimum Tax (AMT)

- Gambling Losses

- Mortgage Interest

- No Tax on Tips / Overtime

- Car Loan Interest

- Trump Accounts

- State and Local Tax (SALT) Deduction

- Casualty Loss Deduction

- Pease Limitation

- Adoption Credit

- Dependent Care Assistance

- Bonus Depreciation

- Energy Credit Terminations

- Scholarship Contribution Credit

- Charitable Contributions for Non-itemizers

Overview

With many Tax Cuts and Jobs Act (TCJA) provisions set to expire after 2025, the newly signed One Big Beautiful Bill Act (OBBBA) both extends and revises a number of key tax policies. While it continues core TCJA measures like reduced individual rates and business deductions, it also introduces new provisions tailored to today’s economic climate.

On July 4th, President Trump signed OBBBA into law, making changes that impact both the 2025 tax year and subsequent years. This summary focuses on provisions that affect individual taxpayers, families, and small businesses—leaving out big business provisions so you can focus on what’s relevant to your own tax planning.

Note: MAGI (Modified Adjusted Gross Income) is generally the same as AGI for most taxpayers, but it also includes certain foreign and territory-excluded income.

Key Provisions and Updates

Individual Tax Rates

- TCJA’s reduced rates are extended beyond 2026.

- Inflation adjustments continue from 2026 onward.

- The 39.6% bracket remains eliminated, favoring higher earners.

Standard Deductions

- Higher TCJA standard deductions are made permanent.

- For 2025: $15,000 (single/MFS), $22,500 (HOH), $30,000 (MFJ).

- OBBBA applies a new inflation adjustment method for 2025—IRS to announce updated amounts.

Senior Tax Deduction (2025–2028)

- $6,000 per senior ($12,000 per couple) if MAGI < $75,000 (single) / $150,000 (MFJ).

- Replaces campaign proposal to remove tax on Social Security.

Child Tax Credit (from 2025)

- Increases from $2,000 to $2,200 per qualifying child; inflation-adjusted annually.

- SSN required for both parent(s) and child.

- Phase-out starts at MAGI $400,000 (MFJ) / $200,000 (others).

Qualified Business Income (QBI) Deduction (from 2026)

- Phase-in thresholds rise to $75,000 (single) / $150,000 (MFJ).

- Minimum QBI Deduction: $400 (inflation-adjusted) if you have ≥ $1,000 QBI from active businesses you materially participate in.

Estate & Gift Tax Exemption (from 2026)

- Increases to $15M (single) / $30M (MFJ), inflation-adjusted annually.

Alternative Minimum Tax (AMT) (from 2026)

- Higher exemptions and phase-out thresholds remain in place.

Gambling Losses (from 2026)

- Loss deduction remains limited to gambling income, now capped at 90% of actual losses.

Mortgage Interest

-

- $750,000 debt cap made permanent ($375,000 MFS).

- Mortgage insurance premiums again deductible as qualified residence interest.

No Tax on Tips & Overtime (2025–2028)

- Tips: Deduction up to $25,000 for qualifying occupations (excludes “specified trades or businesses”).

- Overtime: Deduction limited to pay rate difference; capped at $12,500 (single) / $25,000 (MFJ).

- Shared Rules: Phase-out starts at MAGI $150,000 (single) / $300,000 (MFJ). Must file jointly if married.

Car Loan Interest (2025–2028)

- Deduction up to $10,000 for U.S.-assembled passenger vehicles ≤ 14,000 lbs.

- Phase-out begins at MAGI $100,000 (single) / $200,000 (MFJ).

Trump Accounts (for children born 2025–2028)

- $1,000 initial deposit from federal government.

- Annual contributions: $5,000 (parents), $2,500 (employers).

- Tax-deferred growth; withdrawals taxed as long-term capital gains.

SALT Deduction (2025–2029)

- Cap starts at $40,000 in 2025, rising slightly to $41,624 by 2029.

- Reverts to $10,000 in 2030.

- Phase-out for MAGI ≥ $500,000, bottoming at $10,000.

Casualty Loss Deduction

- Extended to cover state-declared disasters in addition to federal ones.

Pease Limitation

- Permanently repealed after 2025.

- Replaced by a new overall limitation affecting taxpayers in the top bracket.

Adoption Credit (from 2026)

- $5,000 of the credit is now refundable.

Dependent Care Assistance (from 2026)

- Limit rises to $7,500 ($3,750 MFS).

Bonus Depreciation (from Jan. 19, 2025)

- Restores 100% deduction for qualified tangible property.

Energy Credit Terminations (accelerated deadlines)

- Clean vehicle credits and other energy-related credits end between Sept. 30, 2025 and Dec. 31, 2025 (see original list for details).

Scholarship Contribution Credit (from 2026)

- Credit up to $1,700 for contributions to qualifying scholarship organizations; 5-year carryforward.

Charitable Contributions for Non-itemizers (from 2026)

- Up to $1,000 ($2,000 MFJ) in cash donations to qualifying charities.

Why This Matters

The OBBBA introduces significant tax law changes that may affect your 2025 return and beyond. Understanding these provisions now can help you make informed decisions about income timing, deductions, and credits before year-end.

Our office can help you:

- Assess how these changes affect your situation

- Identify new opportunities to reduce your tax burden

- Ensure compliance with updated rules

Contact us today to schedule a tax planning session and prepare for the changes ahead.

Understanding the New Above-the-Line Tax Deduction for Qualified Tips

Key Highlights:

- Changes from prior tip reporting rules

- New above-the-line deduction for qualified tips

- How the deduction works and its limits

- Who qualifies—and who doesn’t

- Expanded FICA tip tax credit for employers

Background: Tip Reporting and Employer Rules

Under prior law, employees receiving $20 or more in tips per month from one employer had to report those tips by the 10th day of the next month. Employers then withheld income and FICA taxes and reported the tips on Form W-2.

For large food and beverage establishments with 10+ employees, employers had to allocate tips so that reported tips equaled at least 8% of gross sales. If reported tips fell short, the employer had to make allocations to cover the difference.

There was also an Employer Social Security Credit—a credit on the employer’s share of Social Security tax paid on tips above certain minimum wage thresholds (Form 8846).

The OBBBA Change: Above-the-Line Deduction for Tips

Starting 2025 through 2028, the “One Big Beautiful Bill Act” offers workers in eligible tip-based jobs an above-the-line deduction of up to $25,000 per tax return (not per person).

This deduction applies whether you itemize or take the standard deduction, and it reduces Adjusted Gross Income (AGI)—which can also improve eligibility for other tax breaks tied to AGI limits.

Important:

- Tips are still subject to FICA tax.

- Self-employed workers must still pay self-employment tax on tips.

What Counts as Qualified Tips

To qualify, tips must:

- Be given voluntarily

- Have no required minimum or penalty for non-payment

- Be non-negotiable and determined by the payer

- Be earned in a trade or business not listed as a “specified service trade or business” under Sec. 199A(d)(2)

- Meet any other requirements issued in future IRS regulations

Both W-2 employees and independent contractors (1099-K, 1099-NEC) can qualify if the occupation is on the Treasury Department’s approved list (expected October 2025).

Self-Employment Considerations

- Tips count as gross business income

- You may deduct up to $25,000 if the business is in a qualifying trade or industry

- Deduction cannot exceed total business income

When You Can’t Take the Deduction

You cannot claim the deduction if:

- You work in a specified service trade or business such as health care, law, accounting, or consulting.

- Your AGI exceeds $150,000 ($300,000 joint), triggering a $100 deduction reduction for every $1,000 over the limit.

- You’re married but don’t file jointly.

- You don’t have a valid, work-eligible Social Security Number.

Expanded FICA Tip Tax Credit for Employers

The law also expands the FICA tip credit—once only for food and beverage businesses—to include beauty services such as hair, nails, esthetics, and spas. This allows these businesses to claim a credit on part of the Social Security taxes paid on tips.

Why This Matters

This above-the-line deduction is one of the most significant tax breaks for tipped workers in years. By lowering AGI, it directly reduces taxable income and may unlock other tax benefits. Employers in newly eligible industries also gain from the expanded FICA tip credit.

Next Step:

If you earn tips or employ tipped workers, plan now for 2025. The rules have complexity—especially around eligibility—so consulting a tax professional is the safest way to maximize your benefit.

📸 Featured Photo Recommendation:

- A realistic restaurant or beauty service scene showing an employee receiving a tip from a customer (cash or digital), with a warm, professional tone.

- It should feel approachable and genuine—something your readers will immediately connect with the concept of tip-based income.

How to Keep Your Business in the Family – Tax Traps and Solutions

You’ve built something real.

You’ve built something real.

A business.

A legacy.

A family-run operation that’s weathered recessions, pandemics, and more sleepless nights than you can count.

Maybe it’s a restaurant. A dental practice. A farm that’s been in the family for generations.

Or maybe it’s a consulting firm you started at your kitchen table with a laptop and a dream.

Now you’re thinking about passing it on—to your daughter, nephew, or niece who just earned an MBA.

But here’s the reality no one tells you:

Running a family business is hard.

Transferring one? Even harder—especially if you don’t plan for the tax traps.

This isn’t just about legal paperwork or naming a successor. It’s about making sure your business survives the transition without collapsing under IRS penalties, valuation disputes, or family conflicts that could have been avoided.

The Hidden Danger of “Just Giving It to the Kids”

You can’t simply hand over your business and call it a day.

If you gift the business, the IRS may treat it as a taxable transfer. Sell it below market value? Same problem.

If the business passes through inheritance, you may face estate taxes, valuation issues, and disputes over what’s “fair.”

The last thing you want is to deal with payroll from probate court.

Common Tax Traps When Transferring a Family Business

1. Capital Gains Shock

Imagine you started your business 20 years ago with $20,000 and it’s now worth $2 million.

If you sell or gift it to your kids now, your original purchase price (basis) goes with it. If they sell it later, they’ll pay capital gains tax on the full difference.

The risk: Gifting might save on estate taxes but could result in a huge capital gains bill for the next generation.

2. S-Corp Ownership Limits

S-Corporations have strict rules on who can be a shareholder—no corporations or partnerships, and only certain trusts qualify.

The risk: Transferring S-Corp shares the wrong way can end S-Corp status and cause costly tax consequences.

3. Gifting Limits and Lifetime Exemption

In 2025, the lifetime gift and estate tax exemption is $13.99 million. In 2026, it will increase to $15 million ($30 million for married couples).

The risk: Exceeding the annual gifting limit without proper documentation reduces your lifetime exemption—sometimes without you realizing it.

4. No Business Valuation

Disagreements over a business’s value can get messy fast—especially if the IRS disagrees with your numbers.

The risk: Gifting or selling ownership without a qualified valuation can lead to disputes and penalties.

5. The Farm and Inheritance Problem

Farms and similar family assets are often land-rich but cash-poor. Without proper planning, heirs may have to sell land just to pay estate taxes.

The risk: Estate taxes can force liquidation of family property when there’s no liquidity to cover the bill.

Final Takeaway

Passing your business to the next generation isn’t just a legal transaction—it’s a strategic process.

Without careful tax planning, the business you spent decades building could face unnecessary taxes, financial strain, or even be lost entirely.

If you’re considering a transfer—whether soon or years from now—consult with a qualified tax professional. The right plan can preserve your legacy, protect your heirs, and ensure the business stays in the family for years to come.